When it Comes to Sports Analytics, Where is the Standard (Deviation)?

In recent years, the use of statistical analytics in sports has been on the rise. Oakland Athletics’ Billy Beane’s Moneyball approach in baseball notably attracted the attention of Hollywood. Daryl Morey of the Houston Rockets has become the face of basketball analytics by building a team that stresses taking shots from only the statistically most optimal locations– leading to a rather aesthetically unappealing style of play comprising of corner threes, layups, and free throws. ESPN has even devoted an entire new section of its webpage – Nate Silver’s FiveThirtyEight - to sports analytics. New metrics to measure an athlete’s performance are seemingly being developed on a daily basis.

Given this ongoing phenomenon, it is remarkable how volatility/standard deviation of athlete performance has seemingly been ignored. Google searching standard deviation in sports really only leads to one meaningful link, a 2008 Bleacher Report article on quarterback performance:

http://bleacherreport.com/articles/44987-measuring-week-to-week-consistency-with-standard-deviation

Be it the media like ESPN, professional leagues like the NBA, or even statistical websites such as BasketballReference.com, convention in sports statistics reporting is to provide either simple averages of performances (i.e. Points Per Game or Batting Average) or more encompassing but slightly esoteric formulas (such as Player Efficiency Rating or Wins Above Replacement). However, a player that scores 15 points every game is simply not the same player that rotates between scoring zero and 30 points every two games, but averages of course would not distinguish between the two players.

The finance industry can be used as a parallel to illustrate the importance of volatility. An investment manager might be most concerned with fundamental ratios such as Price-to-Earnings and Debt-to-Equity when constructing his portfolio; these would be similar to today’s sports statistics of Point Per Game and Player Efficiency Ratings. The investment manager would simultaneously take into account his fund’s volatility to insure it does not exceed his risk tolerance. Similarly, a sports general manager would want to construct a team with an optimal amount of reliable consistent performers and less predictable performers.

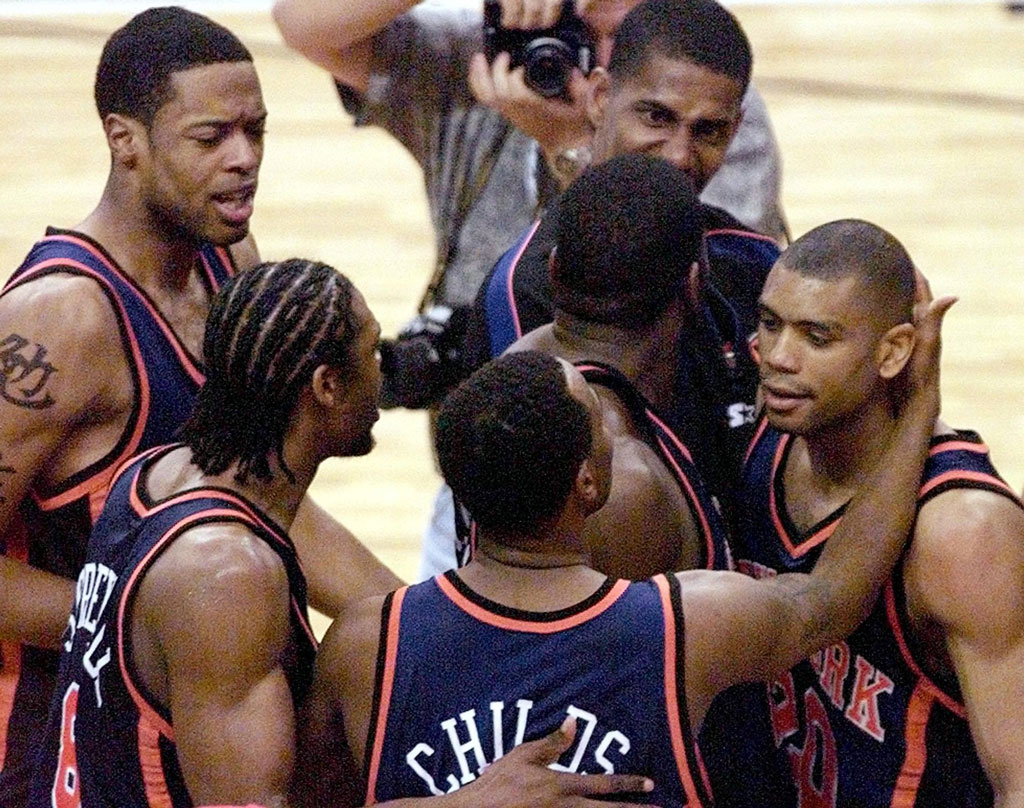

Over the years, sports fans have witnessed underdog teams that have run off remarkable playoff win streaks. Specifically, teams such as the 1999 New York Knicks, the 2007 Golden State Warriors, and the 2011 Connecticut Huskies all might come to mind. A common characteristic of these teams is all had players (Latrell Sprewell, Stephen Jackson, and Kemba Walker respectively) that based off the naked-eye performed rather volatilely. Perhaps general managers who lack the foundational players to win a championship as a favorite should invest more in riskier assets the can offer surprise performances (assuming the ultimate goal is to win a championship). I would like to more thoroughly research this theory.

The 1999 New York Knicks made a surprising run to the NBA Finals as an 8th seed.

Illustrating the simplicity of calculating the standard deviation, I quickly pulled together the scoring standard deviations of few notable NBA players in the 2014-2015 season (table below). I find the table rather informative, in particular we witness what might have been the key to success for the Cleveland Caveliers (who reached the NBA Finals). The celebrated LeBron James was one of the least volatile players studied, illustrating his consistent greatness. He was clearly the foundation of the team’s playoff run. However no team makes it through the playoff without a bit of luck, and LeBron was paired with one of the league’s most hot-and-cold players J.R. Smith. This blend of stability and volatility might be a model for playoff success.

2014-2015 NBA Stats